CHAPTER 7

File for Chapter 7 bankruptcy in Cleveland, OH

Live life Debt-free

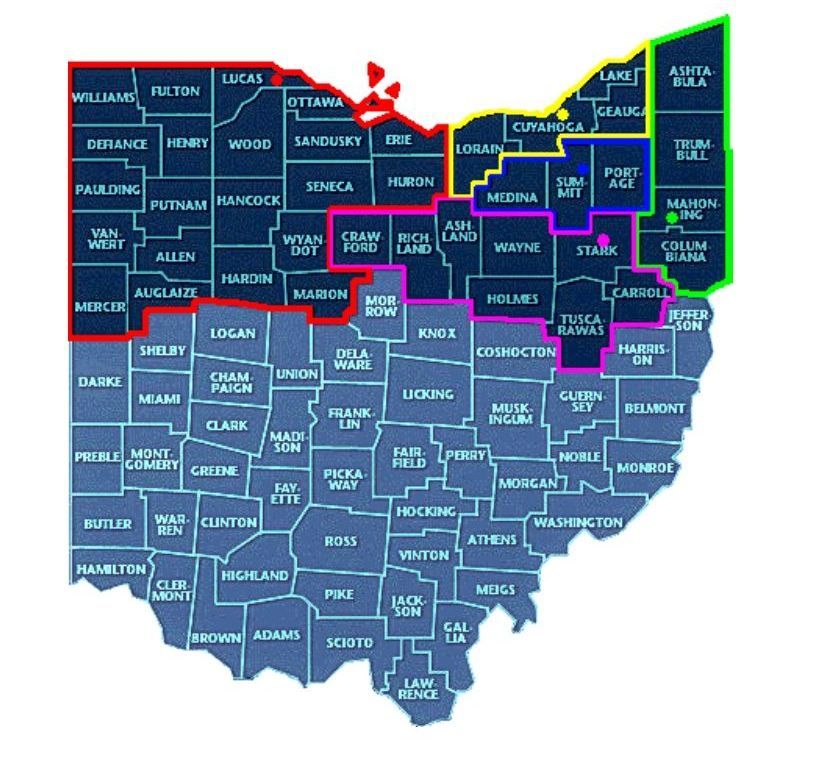

Filing for bankruptcy is never in anyone's long term plans, but I can help you navigate the process if the need arises. I have been practicing Chapter 7 bankruptcy law for over 15 years in the Northern District of Ohio region. Leave the legal stresses to me. Reach out now to set up a consultation.

Chapter 7 Bankruptcy law

Speak with Kathleen Donnelly About Your Options Today

Contact our Firm by sending us an email using the form below.

Contact Us

The Basics of Chapter 7 Bankruptcy

Chapter 7 bankruptcy, is sometimes called "liquidation”. It cancels your unsecured debts. In exchange, you may have to surrender some of your property. The whole Chapter 7 bankruptcy process takes about four months, and commonly requires only one trip to the courthouse.

If you're thinking about filing bankruptcy, you'll probably want to know what property you'll be able to keep. Both federal and state law may allow you to keep your homestead, your automobile, household furnishings, pension, IRA, tax refunds, bank accounts and other tangible and intangible property. These items are called "exempt assets," and the laws that specify what property is exempt are called "exemption statutes." In the overwhelming majority of bankruptcies filed by individuals, all or most of the debtor's property is exempt.

Ohio has generous exemption limits which may allow you to keep your home, car(s), bank accounts and even tax refunds and still discharge debts. For example you are allowed to have personal equity in your home up to $161,375.00 if you are single, $322,750.00 if married and own your home jointly. The personal vehicle exemption is currently $4,450.00 per person per one car. Exemptions have been increasing due to cost of living adjustments.

Until your bankruptcy case ends, your property is under the protection of the Bankruptcy court. During that time, you may not sell or dispose of property you own.

If you've pledged property as collateral for a loan, the loan is a secured debt. The most common examples of secured debts are mortgage loans and auto loans. In most cases, you'll either have to continue to pay for the collateral according to the loan agreement or surrender it to the secured creditor. If you surrender it, you will not owe anything more to that secured creditor. If a judgment creditor has recorded a lien against your property, that debt is also secured. You may be able to wipe out a judgment lien in bankruptcy. Ask me how I can avoid judgment liens if any were filed against you.

If you're a party to a contract or lease, you may choose to cancel (or reject) the contract or lease without further payment obligation. . Alternatively, you may choose to accept (or assume) the contract or lease by continuing to honor the terms of the written agreement, thereby retaining the collateral.

At the end of the bankruptcy process, the debts that qualify for discharge are wiped out by the court. You will no longer legally owe such debts. You may not file for Chapter 7 bankruptcy again for another eight (8) years from the date of your initial Chapter 7 filing.

If you're deeply in debt, bankruptcy may seem like a magic wand. But there are drawbacks. Bankruptcy can be intrusive. You are required to disclose your prior financial activities as well as all your assets in your petition, and to cooperate with the trustee. In addition, creditors and former spouses can create issues by asking questions or disclosing assets that you may have overlooked.

A Discharge Order is typically entered after sixty days following your meeting with the trustee. The entry of a Discharge formally relieves you of the obligation to pay all discharged unsecured debts and secured debts which have not been reaffirmed. In most cases it takes approximately 4 months to complete your case from the filing of your Petition.

The determination of whether or not you wish to keep a secured asset, to reaffirm a secured debt, or to negotiate a “retain and pay” option with a secured creditor on a home mortgage or car loan, needs to be made while your case is pending. Thus, you will have time to discuss and evaluate your options with me and to negotiate manageable payment terms.

I start working for you as soon as you sign an attorney agreement on the dotted line. If you are getting collection agency calls, you need only give them my number as soon as you retain me.

Until then, I am not your lawyer, and nothing in this site creates that relationship.

Bankruptcy law requires that for me to be your bankruptcy lawyer you and I must first enter into a written contract setting forth the terms and conditions of representation.